A common problem that lots of students, or prospective students, have is how they can pay for college. It’s not impossible, but it takes some footwork. I’m going to highlight some important information so that it might make it easier for students to pay for school. Before you do anything on this site fill out a FAFSA (Federal Application for Student Aid) at http://fafsa.ed.gov. If you can’t because of family situations then speak with you financial aid officer at you college. They have the ability to help students out in tight situations. Their whole job is to take into account special circumstances in people’s lives. It may take a little more time but it will be well worth it when you’re done with college and able to support a family.

Scholarships - Do you have a scholarship? Many students have scholarships, or qualify for scholarships and they don’t know it. Florida offers many great scholarships for students who perform well in high school. Be sure to check with your department of education for your state to see what scholarship options are available. There are also websites like scholarships.com and fastweb.com that have huge databases full of scholarships. All you do is fill out some information about you and submit. They match scholarship requirements with your profile and let you know what you have to do. Sometimes all you have to do is simply write a short essay to qualify. If only I could get $500.00 for each thing I write on this site...

Loans - Loans have gotten a bad reputation over the years, usually because of people mismanaging the money they are given. But the American federal government helps students in need. If you demonstrate a financial need the federal government offers subsidized loans. A subsidized loan pretty much means that when you borrow money from a place such as Sallie Mae, the government will pay the interest for you while you’re in school. And the beauty of it is, you don’t have to pay the money back until 6 months after you graduate, for most loans.

Grants - This is a loan that you don’t have to pay back. If you are offered a grant from the federal government, say yes. These are often in the form of PELL grants. In order to qualify for a federal PELL grant you need to fill out a Federal Application for Student Aid(FAFSA) at http://fafsa.ed.gov. The only think better than a grant is a scholarship. The beauty of a grant is that any money you don’t use is yours free and clear. If you can get a scholarship to pay for all of your school, then the entire grant is yours!

Payment Programs - Most colleges offer deferred payment programs where you can make small payments based off of your income to pay the school back. This is another great way to pay for school if you just don’t have the money. It may make things tough for a while trying to pay for school in addition to all of your other bills, but would you rather have it really tough for four short years or live pay check to pay check for the rest of your life?

All of these options are very viable, good things. I suggest you exhaust all of the free money as possible such as scholarships and grants, but after that, loans and payment programs are better then never going in the first place.

When I was in high school I heard a statistic, the statistic was: When you receive your high school diploma, only 13% of the jobs out there are available to you. That’s only going to get worse. You need to get a college degree to be anything. Times might be tough now, but once you get that degree and get a steady job, things will be so much better. Like I said, you have two options: Live pay check to pay check, or don’t live pay check to pay check.I know it sounds like a pretty easy decision to make, but you’d be so surprised at the number of people who choose to live pay check to pay check every day.

There is no good reason not to go to college. There is always a way. The only reason I can think of for someone not going to school is because they’ve convinced themselves that there is absolutely no way they can swing an extra four hours out of their week. Don’t forget, there are also online colleges. You had enough time to read this article; you had enough time to fill out a FAFSA.

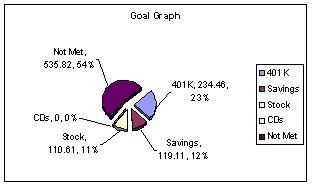

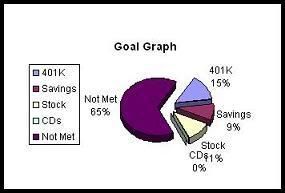

Today's a great day, and I know, it's not much of an update because nothing has changed yet, I'm more or less doing this so I can keep a more detailed log. This is what my saving project currently looks like. I can't wait until the "Not Met" portion of the pie shrinks, that way I can make it bigger again. I hope you'll follow along! With each progress report I'll detail how much goes where and if I make special contributions that may not fall on pay day I'll be sure to tell you where it came from. have a great day everyone!

Today's a great day, and I know, it's not much of an update because nothing has changed yet, I'm more or less doing this so I can keep a more detailed log. This is what my saving project currently looks like. I can't wait until the "Not Met" portion of the pie shrinks, that way I can make it bigger again. I hope you'll follow along! With each progress report I'll detail how much goes where and if I make special contributions that may not fall on pay day I'll be sure to tell you where it came from. have a great day everyone!