Between corporate cutbacks and limiting the number of pencils employees are allotted there’s a lot to learn about saving. The pennies really do count. But before you count the pennies you need to count the dollars. There’s a lot more to saving then just throwing money into a savings account and not looking at it. There’s a process of optimization. Fuel, Electricity, food, and many other expenses can add up, and each expense can usually have a few dollars saved. I’m going to break down many categories of expenditures that can be optimized so that you can save the most.

Fuel – I had a ‘99 Dodge Durango, which cost about 400.00 a month in gas. I now drive a ’07 Toyota Corolla, which only costs me around 100.00 to 150.00 a month and gets me about twice to three times as far. Yes the vehicle costs me more, but my monthly cost to operate my vehicle has dropped by about 33% a month. That’s a huge amount to save. You don’t need to do anything nearly as drastic as I did to save some money on gas either. Simply choosing a faster route to school or work can save a couple cents to dollars each day. Sometimes the shorter root (in terms of distance) uses more gas. You need to consider traffic, stop signs and lights. All of those require accelerating and idling. Those are the biggest gas hogs, peeling out aside.

Electricity – I have an air conditioner that operates off of a timer, it comes on about a half hour before I get home and I turn it off when I leave. Standard incandescent light bulbs (this is more of a penny saver) can be replaced by more efficient Energy saver fluorescent light bulbs. Over the course of eight thousand hours the fluorescents should save about 36.00 to 85.00 each in energy cost. Energy star appliances are also another good way to save some energy. Shutting your computer down, opening windows rather than air conditioning, switching off lights when not in use or not even needed and turning the TV off when you sleep are many other simple habits to get into that can save a ton on electricity over time. Every little bit helps.

Food – It has become far too convenient to eat out at fast food then to cook it yourself. A cheap dollar menu meal quickly turns into a 5.00 meal at McDonalds, not to mention severely unhealthy. Even if you ate twice a week at McDonalds at 5.00 a pop, that’s 40.00 a month or 480.00 a year. The truth being that each time a person eats at a fast food restaurant they spend more than 5.00, and they usually have more than one person. These expenses add up quickly.

You can easily eat at home making your own food, and each meal can cost you under two dollars. People don’t think twice when they spend a dollar on a Coke, when they could easily get 4 to five times more for 3.00 buying a two liter. Or if you want to take the healthy route you can get a gallon of purified water for as little as $0.65.That’s just a few of the ways that you can turn some expenses into savings.

You have to count the dollar and cents you spend, optimize it, then worry about the additional money you want to put in. As little as a dollar savings everyday can amount to 365.00 a year. I imagine that most people can save more than one dollar a day. Two dollars a day ant you’re up to almost $800.00. And it just keeps continuing. If there wasn’t money in counting pennies then credit card companies wouldn’t exist. Of course they do it in mass, but it’s always nice to have little extra when you need to fill the tank.

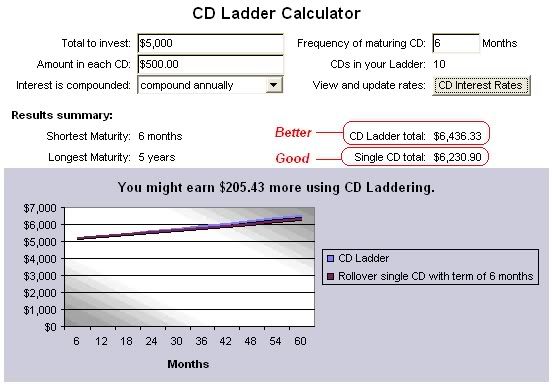

To squeeze a bit more out of your savings, save about 500 – 1000.00 and invest in a CD at a credit union(banks aren't usually able to touch a credit unions interest rates in

most instances). This will allow your money to earn decent interest while preventing you from using the money, but always make sure you have some in savings for emergencies. I’ll be writing out some comprehensive articles on investing in CDs and managing savings. So until then…

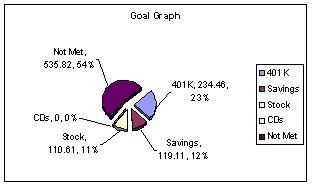

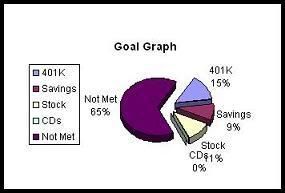

Today's a great day, and I know, it's not much of an update because nothing has changed yet, I'm more or less doing this so I can keep a more detailed log. This is what my saving project currently looks like. I can't wait until the "Not Met" portion of the pie shrinks, that way I can make it bigger again. I hope you'll follow along! With each progress report I'll detail how much goes where and if I make special contributions that may not fall on pay day I'll be sure to tell you where it came from. have a great day everyone!

Today's a great day, and I know, it's not much of an update because nothing has changed yet, I'm more or less doing this so I can keep a more detailed log. This is what my saving project currently looks like. I can't wait until the "Not Met" portion of the pie shrinks, that way I can make it bigger again. I hope you'll follow along! With each progress report I'll detail how much goes where and if I make special contributions that may not fall on pay day I'll be sure to tell you where it came from. have a great day everyone!